Recently, the average 30-year fixed home mortgage rate from Freddie Mac inched approximately 3.1%, and also professionals project prices will certainly proceed climbing with 2022:

” The 30-year fixed-rate home mortgage was 2.9% in the 3rd quarter of 2021. We forecast home mortgage rates to enhance somewhat through the remainder of the year and also get to 3.0%, climbing to 3.5% for complete year 2022.”

![]()

If you’re thinking about purchasing a residence, below are a couple of things to remember so you can do well also as home loan rates rise.

Taking Time Off Can Be Costly

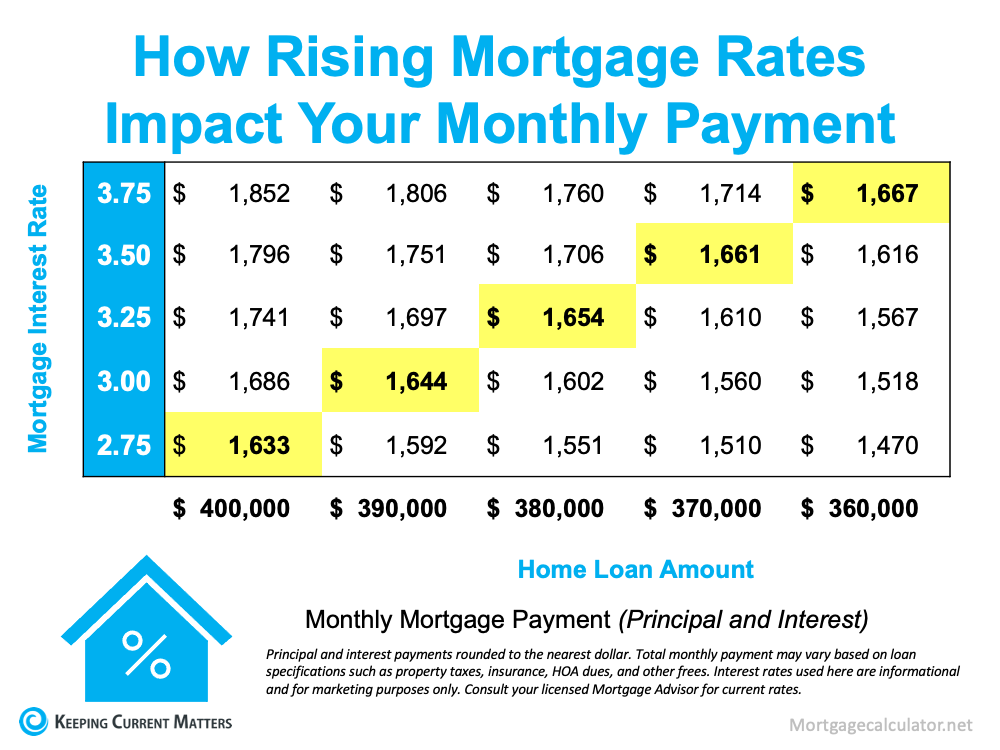

Home mortgage rates play a considerable function in your home search. As rates increase, your monthly mortgage payment increases if you’re buying a home, straight affecting just how much you can pay for. As well as even the tiniest rise can have a big impact on your monthly settlement (see graph below):.

With mortgage rates growing, you’ve most likely seen your purchasing power affected currently. Rather than waiting as well as wishing prices will drop, today’s prices must motivate you to buy now before rates boost much more.

Smart Buyers Can Succeed by Planning Ahead.

You can utilize your newfound motivation to stimulate your search and strategy your following actions accordingly so you’re prepared to act whatever happens with home mortgage prices. One method to do that: take climbing rates right into consideration as part of your budget plan.

Danielle Hale, Chief Economist at realtor.com, places it best, stating:.

” Smart customers should consider computing a regular monthly settlement not only at today’s rates, but also at rates that are a bit higher to ensure that they will not be thwarted by an abrupt upward step …”.

When you find the home that meets your demands, you ought to additionally be ready to act. When the time gets here, that indicates getting pre-approved with a lender so there won’t be any hold-ups.

The most effective method to prepare is to work with a relied on realty expert currently. A representative can connect you with a loan provider, assist you change your search based on your spending plan, and also prepare to act promptly when it’s time to make a deal.

Profits.

Major buyers ought to come close to rising rates as an encouraging aspect to get sooner, not a factor to wait. Waiting will cost you a lot more in the long run. Work with a real estate professional to understand your budget as well as how you can be prepared to purchase your home before rates climb up higher.