There’s a popular economic theory– the law of supply and need– that describes what’s taking place with rates in the existing genuine estate market. Of training course, when need is very high and supply is very low, rates can rise substantially.

Recognizing the influence both supply and need have can give the answers to a few preferred questions about today’s housing market:

Why are costs rising?

Where are rates headed?

What does this mean for buyers?

Why Are Prices Rising?

According to the latest Home Price Insights report from CoreLogic, home rates have increased 18.1% considering that this time in 2014. What’s driving the rise?

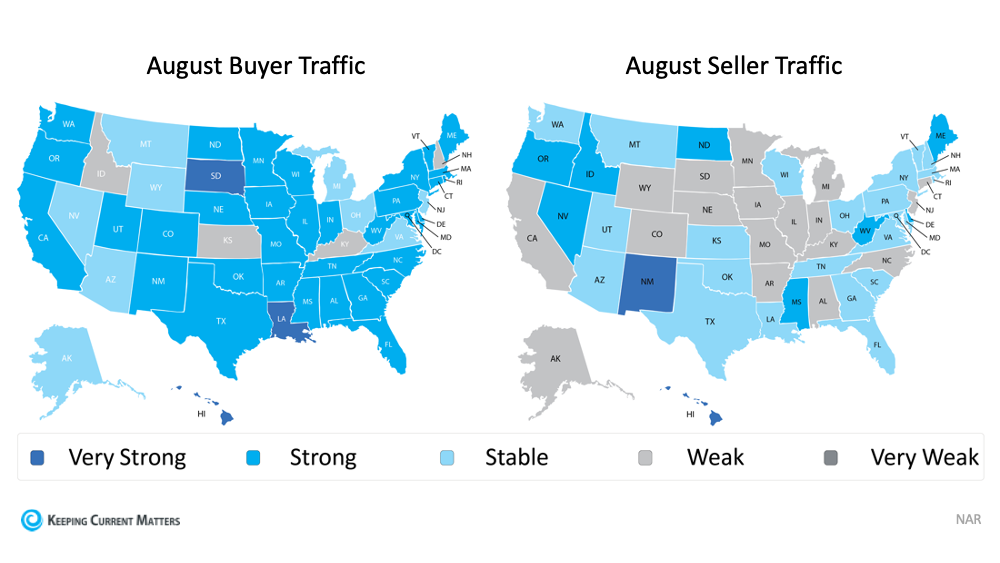

Current buyer as well as seller task data from the National Association of Realtors (NAR) aids respond to that concern. When we take NAR’s buyer task data and compare it to the vendor web traffic during the same duration, we can see customer demand continues to surpass vendor task by a wide margin. In other words, the need for residences is substantially higher than the current supply that’s available to purchase (see maps below):.

This combination of low supply and high demand is what’s driving residence prices up. Bill McBride, writer of the Calculated Risk blog, places it best, saying:.

” By some steps, house rates appear high, however the current rate rises make good sense from a supply and demand perspective.”.

Where Are Prices Headed?

The supply of homes up for sale will significantly influence where prices head over the coming months. Many professionals anticipate prices will certainly remain to enhance, however they’ll likely appreciate at a slower price.

Buyers wanting to acquire the house of their desires might see this as welcome information. In this case, viewpoint is important: a minor moderation of residence prices does not imply costs will certainly fall or diminish. Price boosts may occur at a slower speed, but experts still expect them to climb.

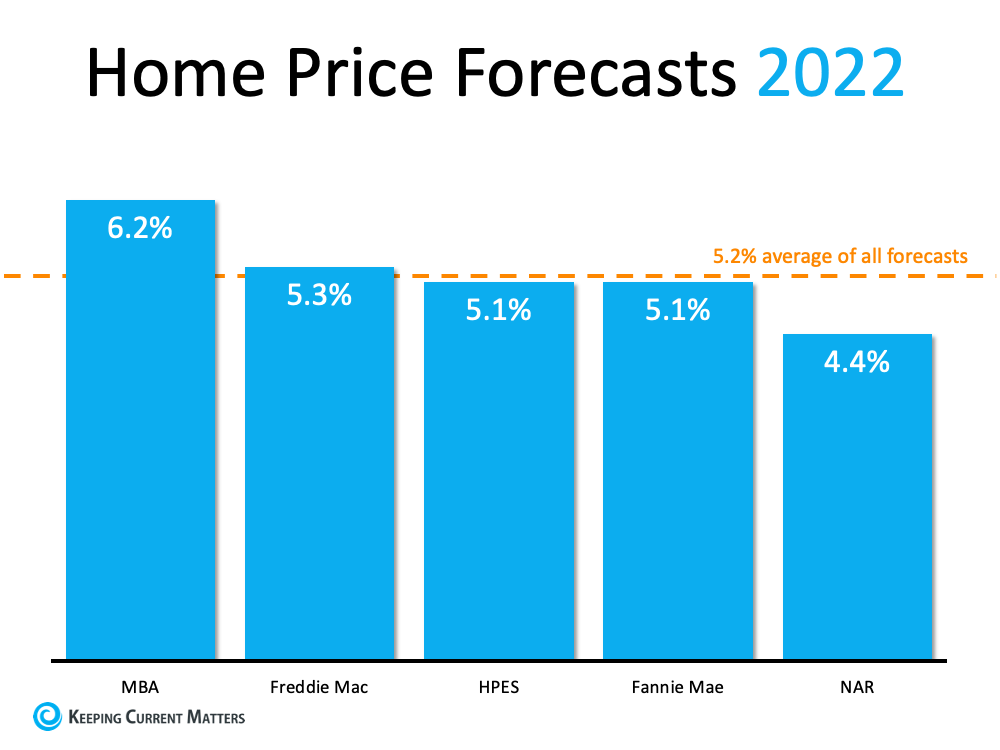

5 major entities that closely adhere to the real estate market forecast residence prices will certainly proceed appreciating through 2022 (see chart listed below):.

What Does This Mean for Homebuyers?

You might finish up paying more in the lengthy run if you’re waiting to go into the market due to the fact that you’re expecting costs to go down. Also if price increases take place at a slower price following year, rates are still projected to climb. That means the residence of your dreams will likely set you back even more in 2022.

Profits.

The truth is, high demand as well as low supply are what’s increasing residence rates in today’s housing market. As well as while prices might raise at a slower speed in the coming months, experts still expect them to rise. Attach with a trusted real estate advisor today to review what that can indicate for you if you wait also much longer to purchase if you’re a prospective homebuyer.