The financial benefits of leasing versus acquiring a home one are constantly up for discussion. One aspect of the formula is usually disregarded– the capability to construct wealth as a property owner.

According to the most up to date research study from the National Association of Realtors (NAR):.

” Homeownership is an essential path to developing riches as well as tightening the racial income as well as riches inequality space. Housing wide range (equity) buildup takes some time and also is developed by cost admiration as well as settling the mortgage.”.

A boost in equity develops the riches of the individual that owns it. This wealth can be given to future generations. The Federal Reserve in an addendum to their Survey of Consumer Finances clarifies:.

” There are various methods households can send wealth and sources across generations. Households can straight move their wealth to the future generation in the kind of a bequest. They can likewise offer the future generation with inter vivos transfers (presents), for instance, offering down payment assistance to make it possible for a home purchase or a considerable wedding gift.”.

The Federal Reserve additionally discusses an additional method riches (consisting of the added total assets generated by a boost in residence equity) can benefit future generations:.

” In addition to direct gifts or transfers, households can make investments in their kids that indirectly enhance their riches. Families can spend in their kids’s educational success by paying for university or exclusive colleges, which can in turn enhance their children’s capacity to gather riches.”.

When you own a home, right here’s a look at exactly how equity can build your riches over time.

Equity over the Last 30 Years.

The NAR research study exposes that the typical gain for house owners over the last five years was $139,134 and over the last 10 years was $218,505. Looking also additionally back in time, the short article says:.

” Homeowners who acquired a typical single-family existing-home 30 years earlier at the average list prices of $103,333 with a 10% deposit loan and also that marketed the building at the mean prices of $357,700 in 2021 Q2 built up real estate wealth of $349,258.”.

Homeownership develops house riches which likewise makes it possible for families to extra quickly move to the home of their dreams. As Mark Fleming, the Chief Economist initially American, clarifies:.

” As property owners gain equity in their residences, they are more probable to consider utilizing that equity to purchase a larger or extra attractive house– the wide range impact of climbing equity.”.

If you lost out on the equity gains over the last 30 years, don’t worry. Experts are still requiring substantial development in equity over the following 5 years.

Looking Forward at the Equity To Come.

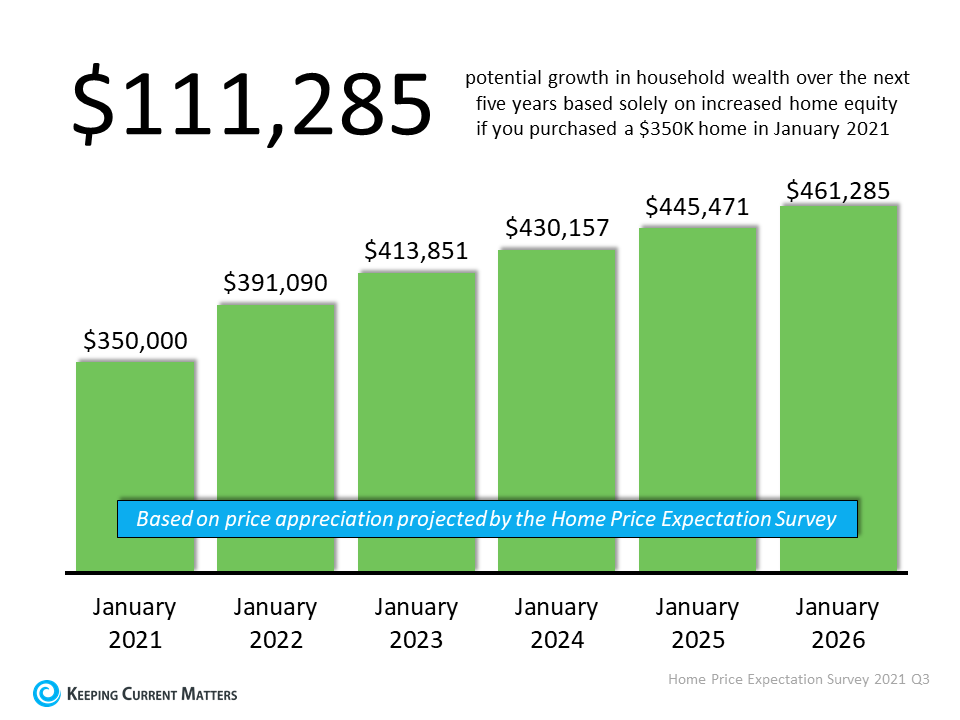

One of the most recent Home Price Expectation Survey, a study of over one hundred economists, realty professionals, and also financial investment and also market strategists, anticipates house worths (and also for that reason equity) to boost as adheres to:.

2021: 11.74%.

2022: 5.82%.

2023: 3.94%.

2024: 3.56%.

2025: 3.55%.

The survey estimates a 31.8% collective appreciation over the next five years. Using their annual projections, the chart listed below shows the equity build-up a buyer could make, making use of a $350,000 house as an example:.

That’s a possible boost in home riches of $111,285 over five years.

Bottom Line.

Owning a residence is one of the ideal methods to expand your wealth over time. Residence riches can influence generations.