There are a lot of inquiries right now pertaining to the property market as we head into 2022. The forbearance program is involving an end as well as home mortgage prices are starting to rise.

With all of this unpredictability, any individual with a loudspeaker– from the mainstream media to an only blogger– has actually realized that problem offers. We’ll continue to see a rash of troublesome headlines over the next few months. To ensure you aren’t immobilized by a headline, look to reliable resources for a look at what to expect from the housing market following year.

There are currently alarmist headings beginning to appear. Here are 2 recent subjects you might have seen in the news.

1. Foreclosures Are Spiking Today

There are a variety of headings flowing that telephone call out the increasing repossessions in today’s property market. Those tales concentrate on an excessively narrow sight on that topic: the current quantity of foreclosures compared to 2020. They emphasize that we’re seeing much more foreclosures this year contrasted to last.

That seems rather discouraging. Nonetheless, though it’s true foreclosures have been up over the 2020 numbers, it’s vital to realize that there were practically no foreclosures in 2015 because of the forbearance plan. If we contrast this September to September of 2019 (the last normal year), repossessions were down 70% according to ATTOM.

Even Rick Sharga, an Executive Vice President of the company that issued the record referenced in the above write-up, states:

” As expected, now that the halt has been over for 3 months, foreclosure task remains to enhance. Yet it’s increasing at a slower price, and also it appears that a lot of the task is largely on uninhabited as well as deserted homes, or car loans in repossession before the pandemic.”

Property owners who have actually been influenced by the pandemic are not typically the ones being strained today. That’s since the forbearance program has actually functioned. Ali Haralson, President of Auction.com, discusses that the program has done an amazing job:

” The tsunami of repossessions many feared in the early days of the pandemic has actually not emerged thanks in big part to the swift as well as definitive repossession securities put in place by federal government policymakers and also the mortgage servicing market.”

And also the federal government is still making sure homeowners have every possibility to remain in their homes. Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB), provided this declaration just recently:

” Failures by home loan servicers as well as regulators worsened the influence of the recession a years earlier. Regulators have actually learned their lesson, and also we will certainly be looking at servicers to ensure they are doing all they can to aid property owners as well as follow the regulation.”

2. Climbing Mortgage Rates Will Slow the Housing Market

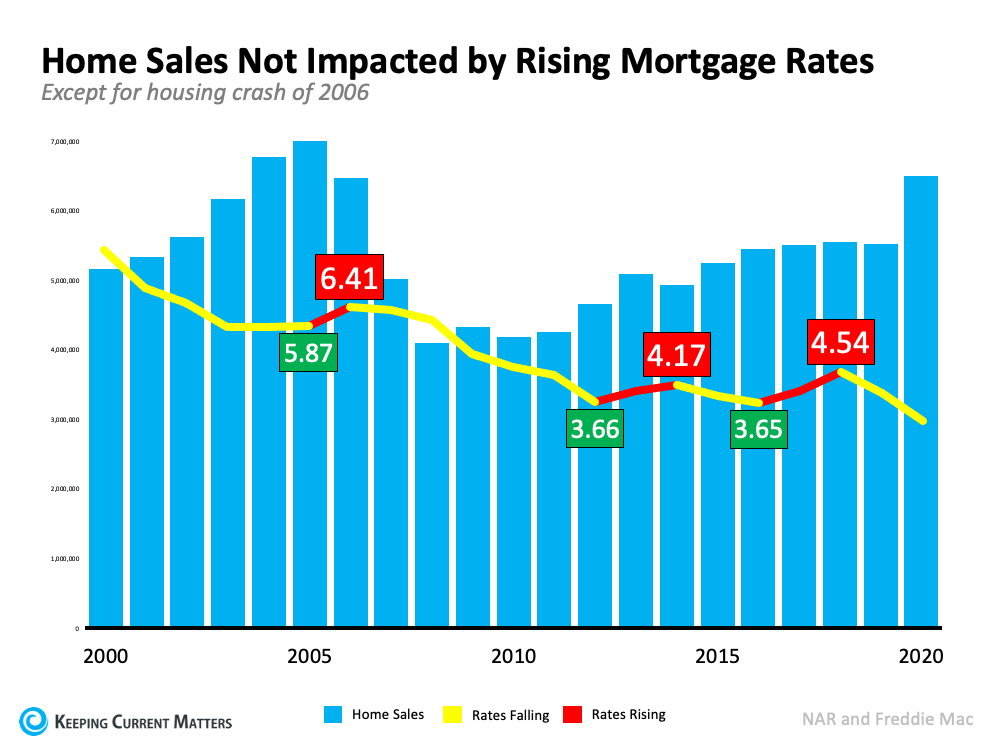

An additional subject that’s creating constant headlines is the surge in home loan prices. Some individuals are revealing worry that rising prices will negatively affect the real estate market by causing residence sales to considerably decrease. The resulting headings are raising unneeded alarm system bells. To neutralize those headings, we require to take a look at what background tells us. Taking a look at data over the last 20 years, there’s no proof that a rise in prices considerably compels sales to come to a stop. Nor does residence cost recognition concerned a screeching stop. Allow’s look at home sales:

The last three times rates increased (received the graph over in red), sales (illustrated in blue in the chart) stayed rather constant. It’s true that sales dropped instead drastically from 2007 with 2010, but home loan prices were also falling at the time. The next two circumstances showed no significant decrease in sales.

Now, allow’s have a look in the house price gratitude (see chart below):.