The last 18 months altered what several buyers are trying to find in a home. Lately, the American Institute of Architects released their AIA Home Design Trends Survey results for Q3 2021. The study exposes the following:

70% of participants desire even more outdoor space

69% of participants desire a home office (48% desired several workplaces).

46% of respondents desire a multi-function room/flexible space.

42% of respondents want an au pair/in-law collection.

39% of respondents want an exercise room/yoga area.

If you’re a home owner that wishes to add any of the above, you have two alternatives: remodel your current residence or buy a residence that already has the spaces you prefer. The choice you make might be established by elements like:.

A feasible desire to relocate.

The distinction in the cost of an acquisition versus a remodelling.

Locating an existing residence or designing a new house that has exactly what you desire (versus trying to restructure the layout of your current home).

In either instance, you’ll require accessibility to resources: the funds for the improvement or the down payment your following home would certainly need. The great information is that the cash you need most likely currently exists in your existing residence in the form of equity.

Residence Equity Is Skyrocketing.

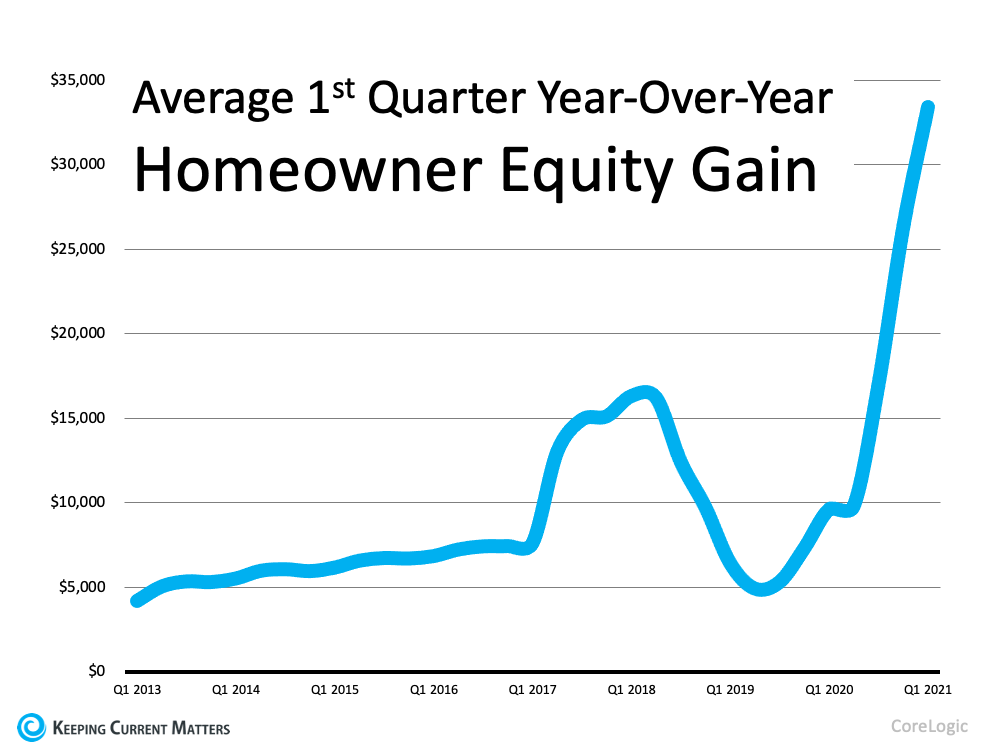

The record-setting boosts in residence rates over the last 2 years drastically boosted homeowners’ equity. The graph listed below usages information from CoreLogic to show the ordinary residence equity gain in the very first quarter of the last nine years:.

Odeta Kushi, Deputy Chief Economist in the beginning American, quantifies the quantity of equity home owners gained recently:.

” Remember U.S. homes possess nearly $35 trillion in owner-occupied realty, just over $11 trillion in the red, as well as the staying ~$ 24 trillion in equity. In rising cost of living adjusted terms, homeowners in Q2 had an average of $280,000 in equity- a historical high.”.

As a house owner, the money you require to purchase the ideal residence or restore your current house may be right within your reaches. Waiting to make your decision may raise the price of tapping that equity.

If you choose to refurbish, you’ll need to refinance (or take out an equity lending) to access the equity. If you choose to relocate instead and utilize your equity as a deposit, you’ll still need to mortgage the remaining distinction in between the down payment as well as the expense of your next home.

Mortgage prices are anticipated to raise over the next year. Waiting to utilize your equity will possibly indicate you’ll pay more to do so. According to the latest information from the Federal Housing Finance Agency (FHFA), almost 57% of current home mortgage owners have a home mortgage rate of 4% or listed below. If you’re one of those house owners, you can maintain your home loan rate under 4% by doing it now. If you’re one of the 43% of homeowners with a mortgage price over 4%, you might be able to do a cash-out re-finance or get an extra pricey residence without dramatically enhancing your regular monthly repayment.

Very First Step: Determine the Amount of Equity in your house.

If you’re prepared to either revamp your existing home or discover an existing or freshly created residence that has every little thing you desire, the initial thing you require to do is identify how much equity you have in your present house. To do that, you’ll require two points:.

The current home mortgage equilibrium on your residence.

The current worth of your home.

You can probably find the home loan balance on your month-to-month mortgage declaration. To discover the existing market value of your home, you can pay several thousands of dollars for an assessment, or you can speak to a local property expert who will certainly have the ability to provide to you, at on the house, a specialist equity assessment record.

Bottom Line.

If the previous 18 months have redoubled your thoughts on what you want from your house, currently might be the time to either refurbish or make a relocation to the excellent house.