Opportunities are you’ve listened to talk concerning today’s climbing residence rates if you’re looking to acquire or sell a residence. As well as while this boost in residence values is terrific news for vendors, you might be questioning what the future holds. Will prices continue to increase with time, or should you anticipate them to fall?

To address that concern, allow’s first recognize a couple of terms you might be hearing today.

Appreciation is an increase in the worth of a property.

Depreciation is a decrease in the value of a possession.

When something happens at a slower rate, Deceleration is.

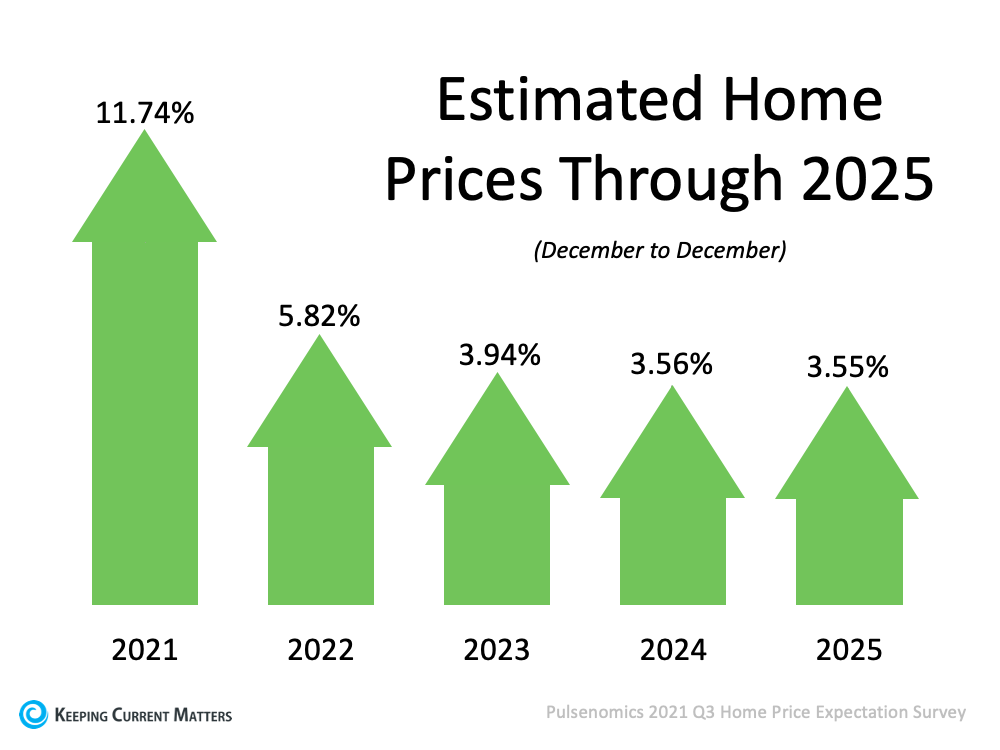

It’s important to keep in mind home costs have boosted, or valued, for 114 straight months. To find out if that trend might continue, want to the professionals. Pulsenomics surveyed over 100 economic experts, investment strategists, and real estate market analysts requesting for their five-year forecasts. In terms of what lies ahead, specialists claim the marketplace might see some minor deceleration, however not depreciation.

Right here’s the forecast for the next few years:

As the graph over programs, costs are anticipated to continue to rise, just not at the same rate we’ve seen over the last year. Over 100 experts concur, there is no expectation for price devaluation. As the arrows suggest, each number is an increase, which means costs will increase yearly.

Bill McBride, writer of the blog site Calculated Risk, additionally expects slowdown, but not devaluation:

” My feeling is the Case-Shiller National annual development price of 19.7% is most likely near to a top, which year-over-year rate boosts will certainly slow later this year.”

Ivy Zelman of Zelman & Associates agrees, claiming:

” … residence cost recognition is on the cusp of flipping to a decreasing trend.”

A current post from realtor.com shows you should anticipate:

” … annual rate boosts will slow to a more typical degree, …”.

What Does This Deceleration Mean for You?

What experts are predicting for the years in advance is more in accordance with the historical standard for admiration. According to information from Black Knight, the ordinary annual admiration from 1995-2020 is 4.1%. As you can see from the graph above, the expert forecasts are more detailed to that speed, which implies you need to see recognition at a degree that’s aligned with an extra normal year.

If you’re a purchaser, don’t expect a drastic or sudden decrease in home prices– experts say it won’t occur. Rather, think about your homeownership goals and think about purchasing a home before rates climb even more.

If you’re a seller, the ongoing residence cost admiration is good news for the worth of your residence. Deal with a representative to detail your house for the right rate based on market conditions.

Bottom Line.

Professionals anticipate cost slowdown, not rate devaluation over the coming years. Talk with a regional real estate expert to recognize what’s happening in the housing market today, where points are headed, and what it implies for you.