With forbearance strategies pertaining to an end, several are concerned the housing market will experience a wave of foreclosures comparable to what happened after the real estate bubble 15 years back. Right here are a couple of reasons that won’t take place.

There are fewer property owners in difficulty this time

After the last real estate collision, about 9.3 million homes shed their residences to a repossession, brief sale, or because they merely offered it back to the financial institution.

Since last Friday, the overall variety of mortgages still in forbearance stood at 1,221,000. That’s much less than the 9.3 million houses that lost their residences simply over a decade ago.

The majority of the home mortgages in forbearance have sufficient equity to market their houses

Because of rapidly rising home costs over the last 2 years, of the 1.22 million home owners currently in forbearance, 93% have at the very least 10% equity in their houses. This 10% equity is necessary since it allows homeowners to market their homes and pay the relevant expenditures rather than dealing with the hit on their credit that a foreclosure or short sale would certainly develop.

As stay-at-home orders were provided early last year, the anxiety was the pandemic would certainly affect the housing sector in a comparable way. Many projected up to 30% of all mortgage holders would get in the forbearance program. In truth, just 8.5% in fact did, which number is now down to 2.2%.

The staying 7% might not have the option to sell, yet if the entire 7% of those 1.22 million houses went into repossession, that would certainly complete about 85,400 home loans. To consider that number context, right here are the yearly repossession numbers for the 3 years leading up to the pandemic:

2017: 314,220

2018: 279,040

2019: 277,520

The possible number of foreclosures appearing of the forbearance program is nowhere near the number of repossessions that affected the housing crash 15 years ago. It’s really much less than one-third of any of the 3 years prior to the pandemic.

The current market can soak up listings coming to the market

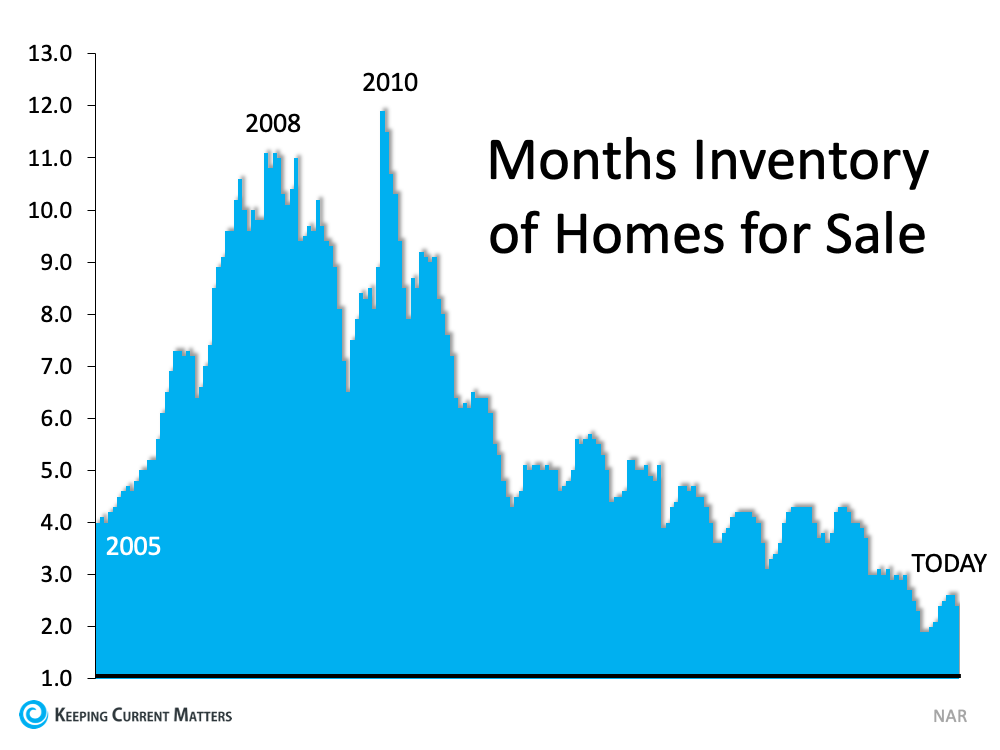

When repossessions hit the market back in 2008, there was an excess of residences available for sale. It’s specifically the contrary today. In 2008, there was over a nine-month supply of listings on the marketplace. Today, that number is much less than a three-month supply. Here’s a chart revealing the difference in between the two markets.

Profits

The information suggests why Ivy Zelman, founder of the significant housing market analytical company Zelman as well as Associates, was on point when she mentioned: